Share this via

‘Better investment options, better wealth management services, better market connectivity, better tax regulations and economic and political stability are the reasons for Indian HNWIs investing in offshore assets’

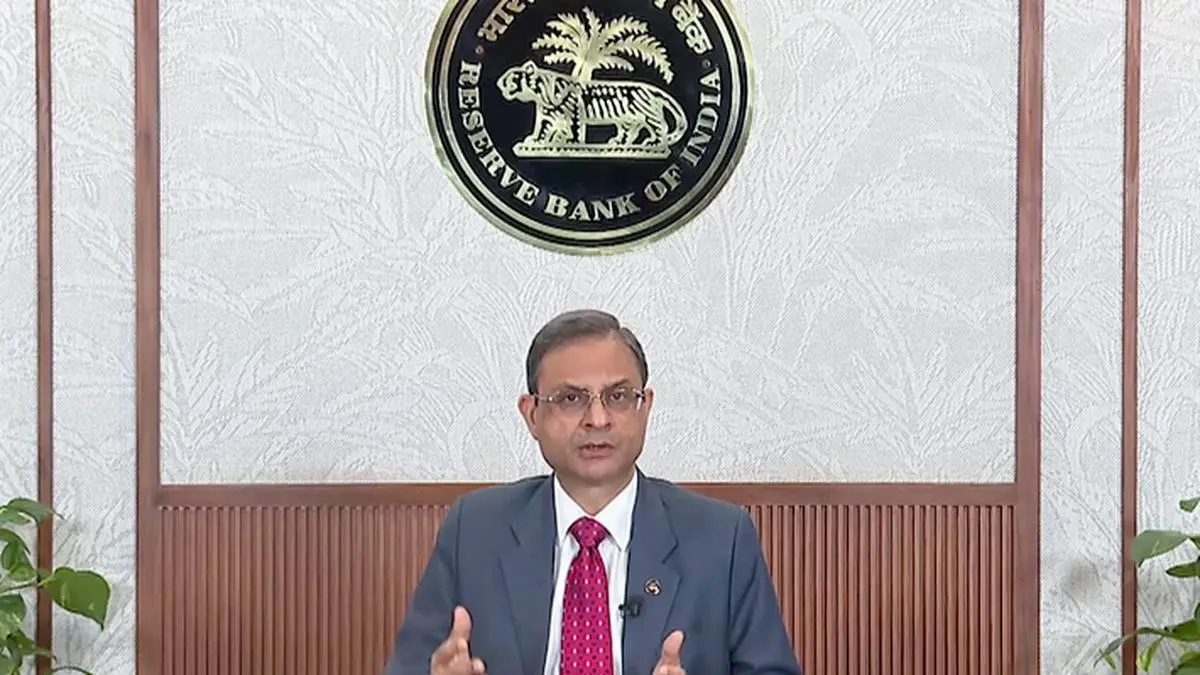

RBI Governor Sanjay Malhotra says the MPC felt frontloading of rate cut will boost growth; the RBI MPC changes its policy stance from 'accommodative' to 'neutral'.

RBI cuts the repo rate by 50 bps to 5.5%. This is expected to reduce FD interest rates also. Here's what investors should do now.

Recovering all the early lost ground, the 30-share BSE Sensex jumped 591.94 points to 82,033.98 in morning trade. The 50-share NSE Nifty climbed 205.2 points to 24,956.10.

New rules for HDFC and ICICI credit cards from July 1 will impact rent payments, online gaming, wallet loads, fuel spends, and ATM transactions

‘From here onwards, the MPC will be carefully assessing the incoming data and the evolving outlook to chart out the future course of monetary policy in order to strike the right growth-inflation balance’

According to a report by brokerage house Quant Mutual Fund, after an impressive upside move in the past few months, gold prices might fall by 12-15% in the next two months.

Indian benchmark indices are set to trade cautiously on Friday, as investors brace for a mix of domestic and global triggers

RBI Monetary Policy Committee Meeting June 2025 Live: Governor Sanjay Malhotra announce interest rate decision

In a surprise move, the RBI slashed the repo rate by 50 basis points to 5.5%, exceeding expectations. This decision, driven by a lower projected inflation rate of 3.7% and a need to boost domestic growth, aims to reduce home loan EMIs a ...more

RBI Repo Rate Cut: cut the repo rate by 50 basis points, reducing it to 5.50 percent. This will lower EMIs for existing customers and make new loans more affordable.

The country's FX reserves are now about $13.4 billion below their all-time high hit in September 2024

Get over your FOMO of knowing what's happening. Never miss what matters to you!